Author: Mike Cosentino

-

Business Development Company (BDC) Senior Bonds: Enhanced Risk-Adjusted Returns vs. Other Corporate Bonds

•

Join the webinar as the speakers discuss: Watch Now →

-

Q&A with Tony Sirianni: Prospect Capital’s Grier Eliasek

•

Tony Sirianni had the chance to sit down with Grier Eliasek, President & COO, Prospect Capital to talk about the success growing their practice, and the industry in general.

-

Prospect Capital Management is Named a Top Private Credit Firm

•

Prospect Capital Management L.P., investment adviser to Prospect Capital Corporation and other funds, announced today that GrowthCap has named Prospect a Top Private Credit Firm of 2025.

-

Enhancing Yields with Collateralized Loan Obligations and Other Asset Backed Securities

•

Join the webinar as the speakers discuss: Watch Now →

-

-

Middle-Market Direct Lending Trends Continued

•

Please join Grier Eliasek (President/COO & Co-CIO) and David Moszer (MD, Private Credit) for their continued discussion of middle-market lending trends, financing, and more.

-

Private Debt Investor Features Grier Eliasek in June Edition of Middle Market Direct Lending Report

•

Prospect Capital Corporation’s President and Chief Operating Officer, Grier Eliasek, is featured in the June 2025 Private Debt Investor Middle Market Direct Lending Report.

-

Private Debt Investor Expert Q&A with Grier Eliasek

•

The lower mid-market presents an attractive opportunity to secure advantageous deal terms in pursuit of higher risk-adjusted returns, says Grier Eliasek, president of Prospect Capital

-

Prospect Capital Honored for 2025 Middle-Market Deals of the Year Awards for Druid City Independent Sponsor Investment in Healthcare Industry

•

Prospect Capital Management L.P. (“Prospect”), investment adviser to Prospect Capital Corporation (NASDAQ: PSEC) and other funds, announced today that Prospect has received an Honorable Mention in Mergers & Acquisitions’ 2025 Middle-Market Deals of the Year Awards for Prospect’s role in providing value-added capital to Druid City Infusion (“Druid City”).

-

Medium Term Notes: Senior Position and Attractive Income

•

This webcast will provide an overview on senior unsecured bonds, medium term notes, and how a portfolio can benefit from programmatic bonds through: Watch Now →

-

Prospect’s Real Estate Private Credit Platform Provides $10.9 Million to Class A Stabilized Cash Flowing Multifamily Property in Brooklyn

•

Prospect Capital Management L.P. (“Prospect”), investment adviser to Prospect Capital Corporation (NASDAQ: PSEC), through its real estate private credit platform, has closed on an investment to recapitalize The Frederick, a 193-unit, Class A stabilized cash flowing multifamily property in Brooklyn, New York. Constructed in 2018, the property is owned by…

-

Healthcare Private Credit 2025 Market Outlook

•

The healthcare sector continues to be a pivotal driver in the direct lending market, accounting for a significant portion of recent deal activity. In 2024, healthcare represented approximately ~20% of all direct lending deals, underscoring the sector’s prominence in private credit markets.

-

Prospect Capital Named One of the Best Places to Work in the Private Capital Industry

•

Prospect Capital Management L.P. (“Prospect”), investment adviser to Prospect Capital Corporation (NASDAQ: PSEC) and other funds, announced today that Prospect is honored to be named a Best Place to Work in Private Capital of 2024 by Mergers & Acquisitions. To determine the winners, Mergers & Acquisitions evaluated firms in areas…

-

Prospect Capital Achieves Outstanding Corporate Culture Recognition Based on Independent Culture Amp Survey

•

Prospect Capital Management L.P. (“Prospect”), investment advisor to Prospect Capital Corporation (NASDAQ: PSEC) and other funds, is pleased to announce the results of a third party study conducted by one of the world’s leading employee experience platform, Culture Amp, showcasing Prospect’s commitment to fostering an exceptional workplace environment. The comprehensive,…

-

Prospect’s Real Estate Platform Provides $12 Million in Preferred Equity to Class A Stabilized Cash Flowing Multifamily Property in Scottsdale

•

Prospect Capital Management L.P. (“Prospect”), through its real estate platform, has closed on a preferred equity investment to recapitalize the Roadrunner on McDowell, a 356-unit, Class A stabilized cash flowing multifamily property in Scottsdale, Arizona. Constructed in 2021, the property is owned by KB Development, a privately-owned multifamily operator headquartered…

-

Understanding The Lower Middle Market

•

Many advisors are seeking alternative income options and improved risk/return portfolio outcomes for their clients. Understanding the benefits and risks and various considerations of investing in private credit is critical to proper portfolio management. Please join us for this in-depth discussion that will cover: Watch Now →

-

Middle-Market Direct Lending Trends

•

Join Grier Eliasek (President and COO of Prospect Capital Corporation) and David Moszer (Managing Director) for a discussion of middle-market direct lending trends, financing, and more.

-

Preferred Stock as a Low Volatility, Downside Protected and Income Generating Asset Class

•

This webcast will provide an overview on the preferred asset class and what makes it different than other fixed income and alternative investments, including low volatility, downside protection, and income generation benefits. Attendees will learn about the structure of non-traded preferred stock and how it fits into a portfolio. Watch…

-

Understanding Private Credit

•

Many advisors are seeking alternative income options and improved risk/return portfolio outcomes for their clients. Understanding the benefits and risks and various considerations of investing in private credit is critical to proper portfolio management. Please join us for this in-depth discussion that will cover: Watch Now →

-

Priority Income Fund: Understanding Senior Secured Loans and Collateralized Loan Obligations

•

Prospect Capital presents Priority Income Fund, a 1940 Act closed-end registered investment company that invests in equity and junior debt tranches of Collateralized Loan Obligations (“CLOs”), or pools of first lien senior secured loans to large U.S.-based companies. Join us for this in-depth discussion to learn more about senior secured…

-

Prospect Capital Management Partners with iCapital to Expand Investment Advisor Access to Closed End Fund (CEF) and Business Development Company (BDC) Opportunities

•

Prospect Capital Management L.P. announced today a strategic partnership with iCapital, the global fintech platform driving access to alternative investments for the asset and wealth management industries.

-

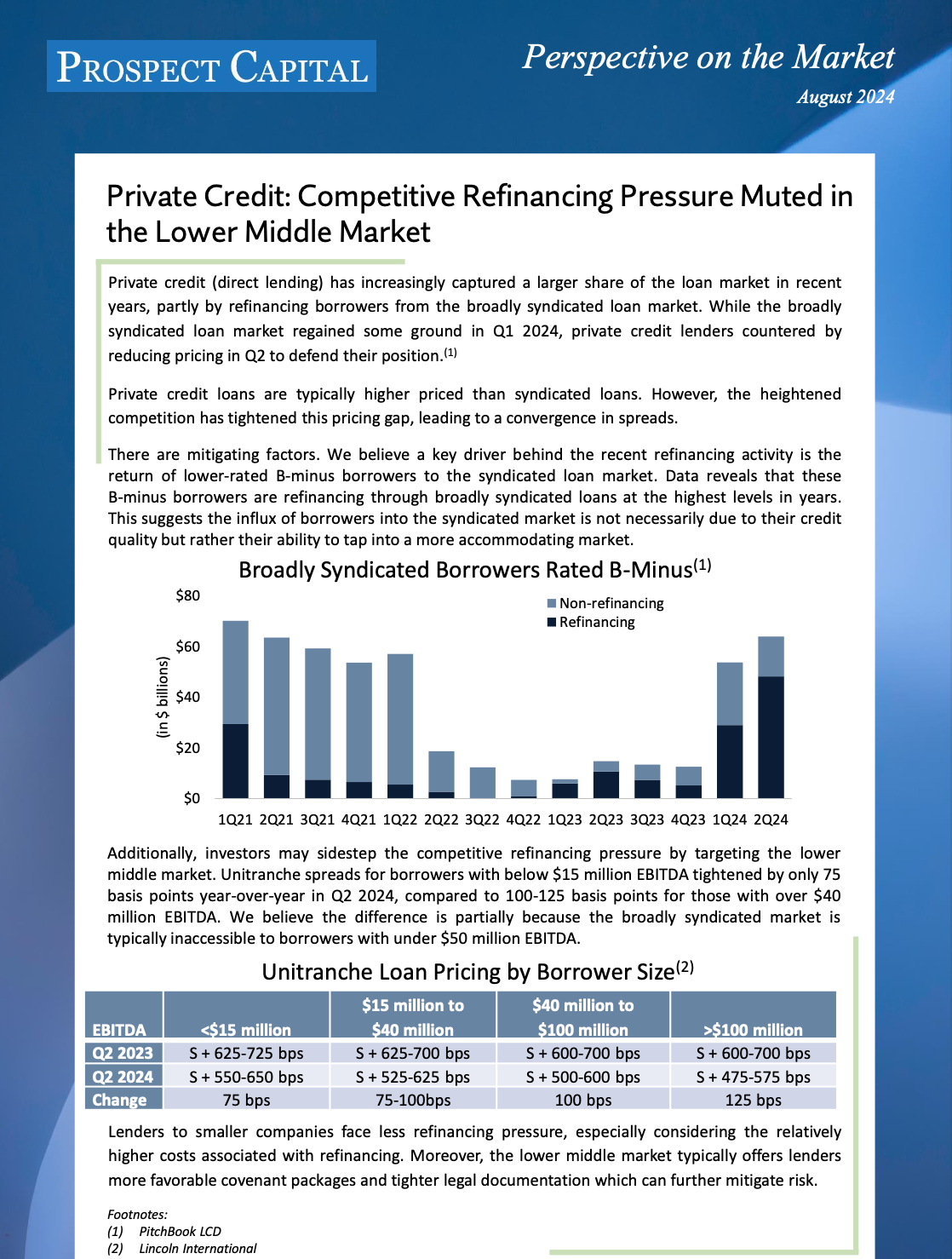

Private Credit: Competitive Refinancing Pressure Muted in the Lower Middle Market

•

Private credit (direct lending) has increasingly captured a larger share of the loan market in recent years, partly by refinancing borrowers from the broadly syndicated loan market. While the broadly syndicated loan market regained some ground in Q1 2024, private credit lenders countered by reducing pricing in Q2 to defend…

-

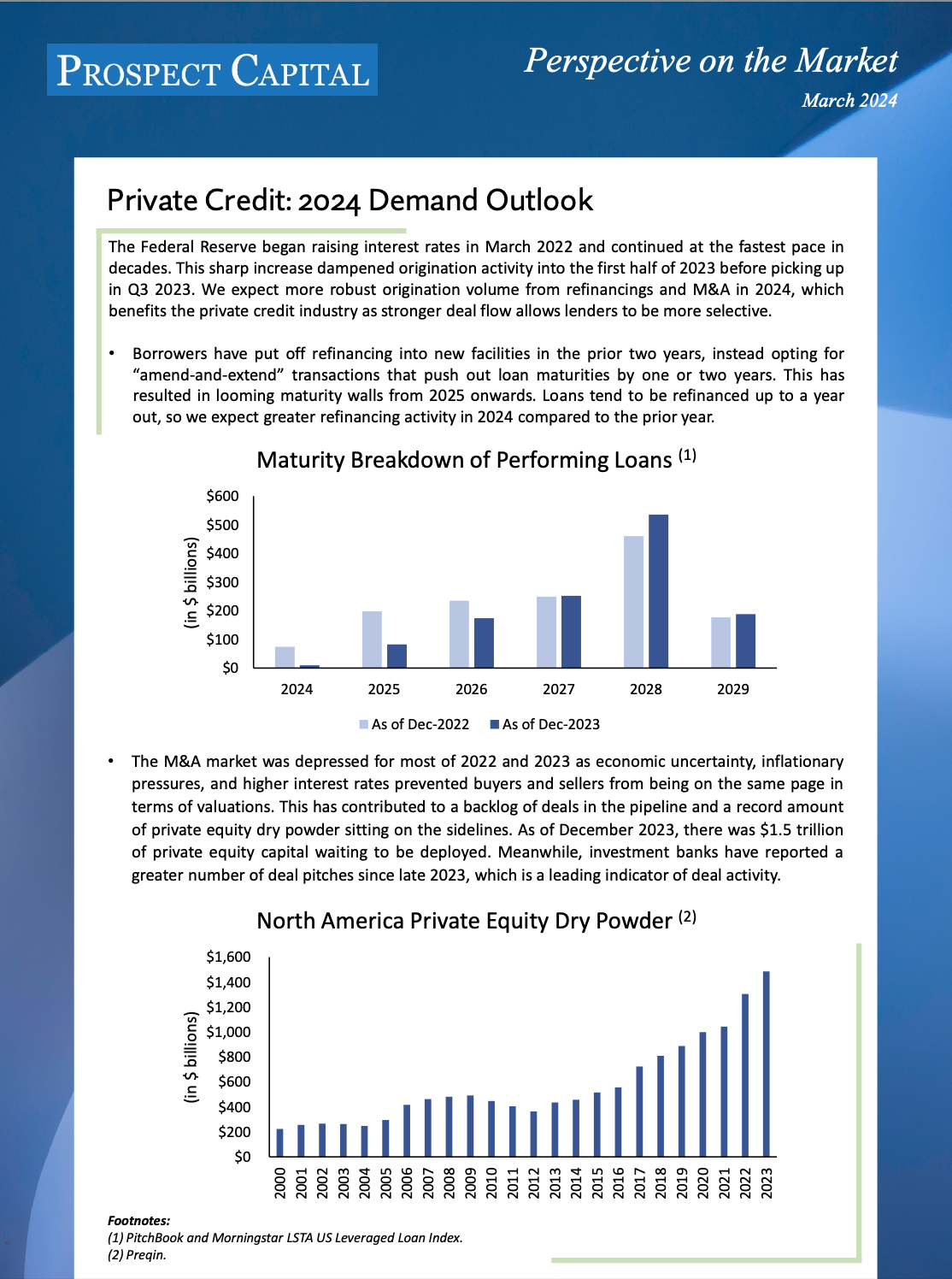

Private Credit: 2024 Demand Outlook

•

The Federal Reserve began raising interest rates in March 2022 and continued at the fastest pace in decades. This sharp increase dampened origination activity into the first half of 2023 before picking up in Q3 2023. We expect more robust origination volume from refinancings and M&A in 2024, which benefits…

-

Prospect Capital Management is Named a Top Private Debt Firm

•

Prospect Capital Management L.P. (“Prospect”) announced today that GrowthCap has named Prospect a Top Private Debt Firm of 2023. “Thank you to GrowthCap for recognizing our longstanding approach and dedication” said John Barry, CEO of Prospect. He added, “We are proud of our long history of providing important capital to…

-

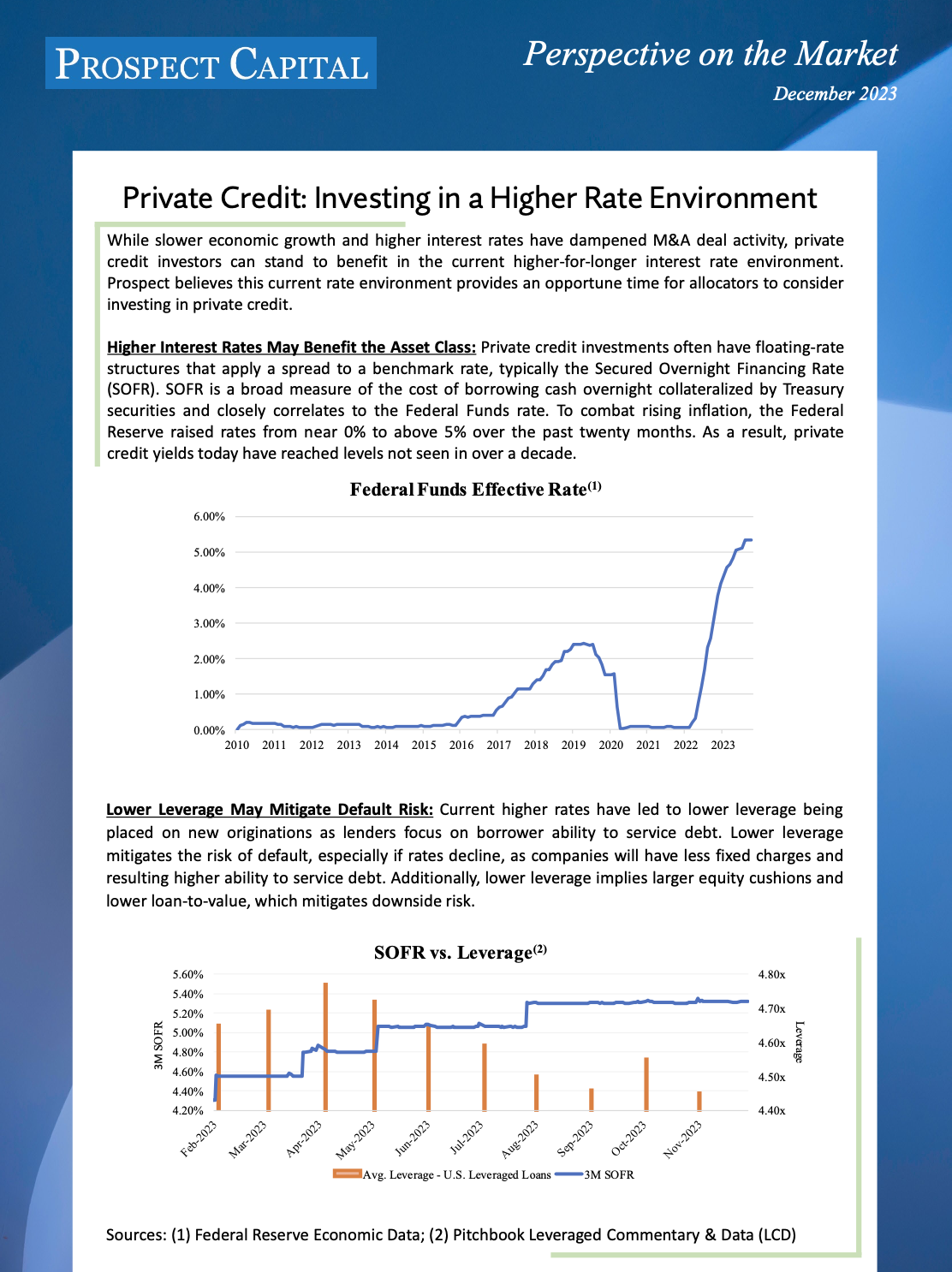

Private Credit: Investing in a Higher Rate Environment

•

While slower economic growth and higher interest rates have dampened M&A deal activity, private credit investors can stand to benefit in the current higher-for-longer interest rate environment. Prospect believes this current rate environment provides an opportune time for allocators to consider investing in private credit. Higher Interest Rates May Benefit…

-

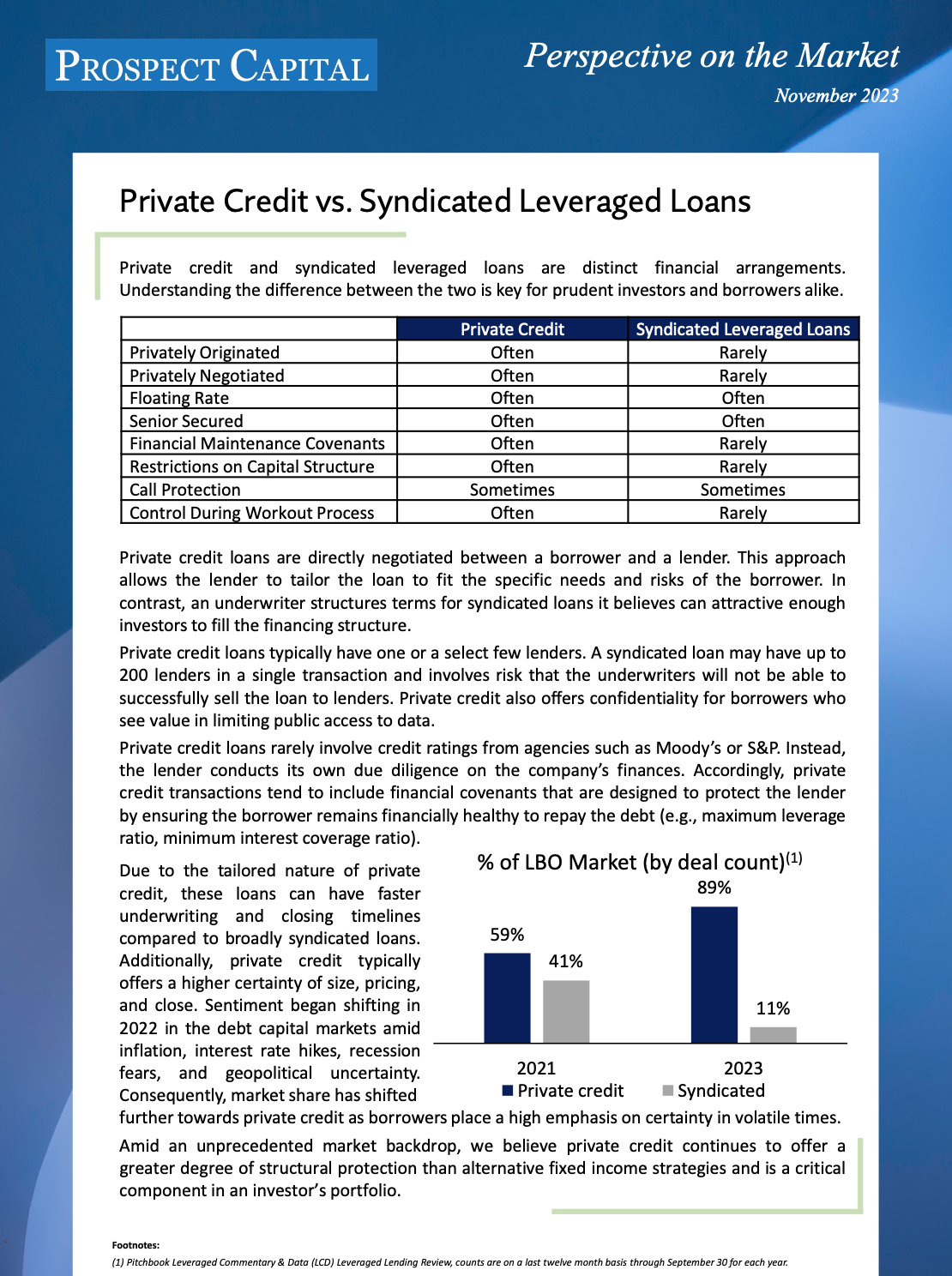

Private Credit vs. Syndicated Leveraged Loans

•

Private credit and syndicated leveraged loans are distinct financial arrangements. Understanding the difference between the two is key for prudent investors and borrowers alike. Private Credit Syndicated Leveraged Loans Privately Originated Often Rarely Privately Negotiated Often Rarely Floating Rate Often Often Senior Secured Often Often Financial Maintenance Covenants Often Rarely…

-

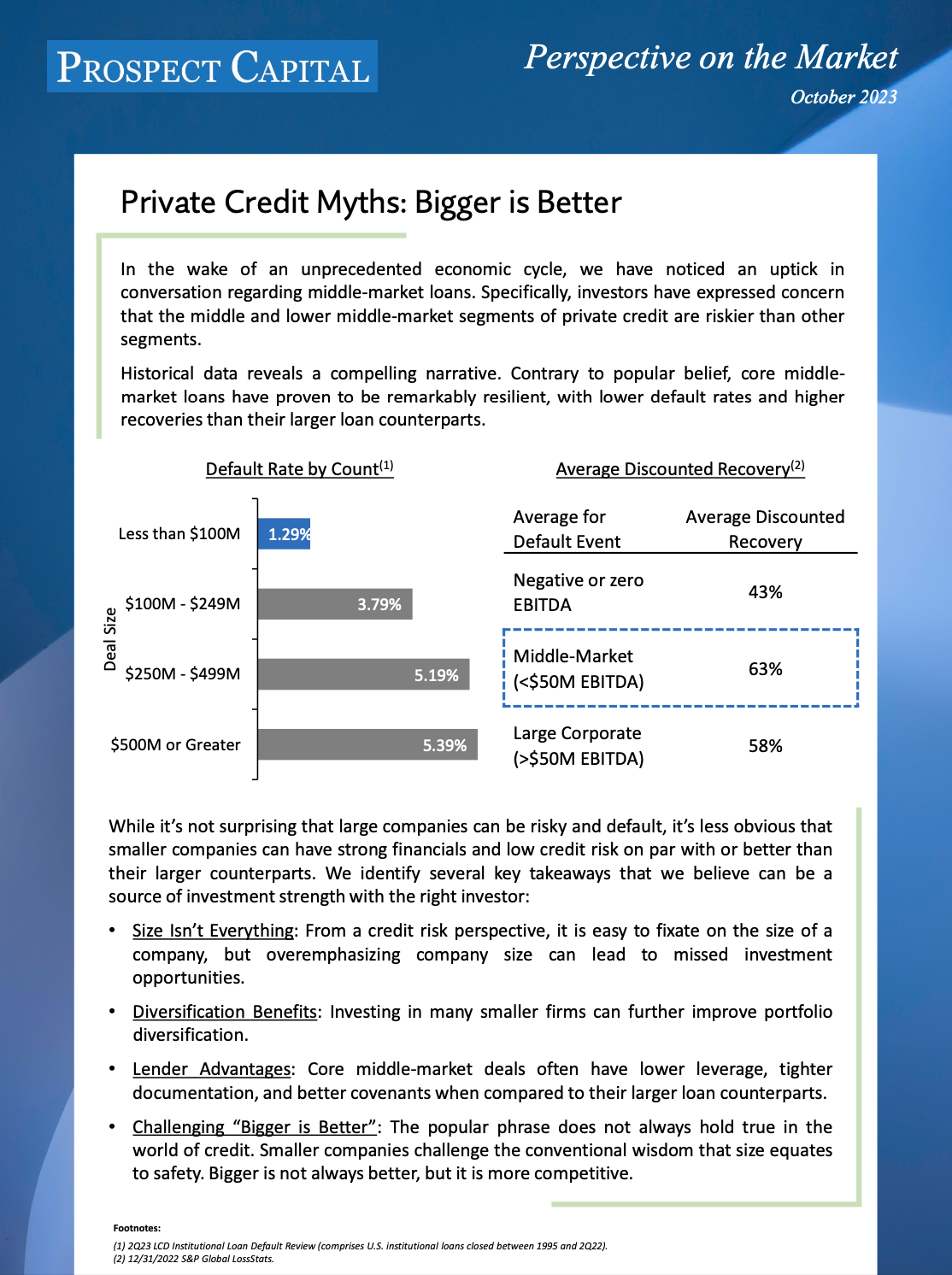

Private Credit Myths: Bigger is Better

•

In the wake of an unprecedented economic cycle, we have noticed an uptick in conversation regarding middle-market loans. Specifically, investors have expressed concern that the middle and lower middle-market segments of private credit are riskier than other segments. Historical data reveals a compelling narrative. Contrary to popular belief, core middle-market…

-

Prospect Capital Management Wins Best Real Estate Investor USA

•

Prospect Capital Management L.P. (“Prospect”) announced today that Capital Finance International (“CFI”) has named Prospect the Best Real Estate Investor USA. The award recognizes organizations that contribute significantly to the convergence of economies and add value for all stakeholders. CFI has awarded Best Real Estate Investor USA to Prospect based…

-

Prospect Capital Management Wins Best Middle-Market Lending Investor USA

•

Prospect Capital Management L.P. (“Prospect”) announced today that Capital Finance International (“CFI”) has named Prospect the Best Middle-Market Lending Investor USA. The award recognizes organizations that contribute significantly to the convergence of economies and add value for all stakeholders. CFI has awarded Best Middle-Market Lending Investor USA to Prospect based…