The healthcare sector continues to be a pivotal driver in the direct lending market, accounting for a significant portion of recent deal activity. In 2024, healthcare represented approximately ~20%1 of all direct lending deals, underscoring the sector’s prominence in private credit markets.

Several considerations for investing in healthcare in 2025:

Opportunities

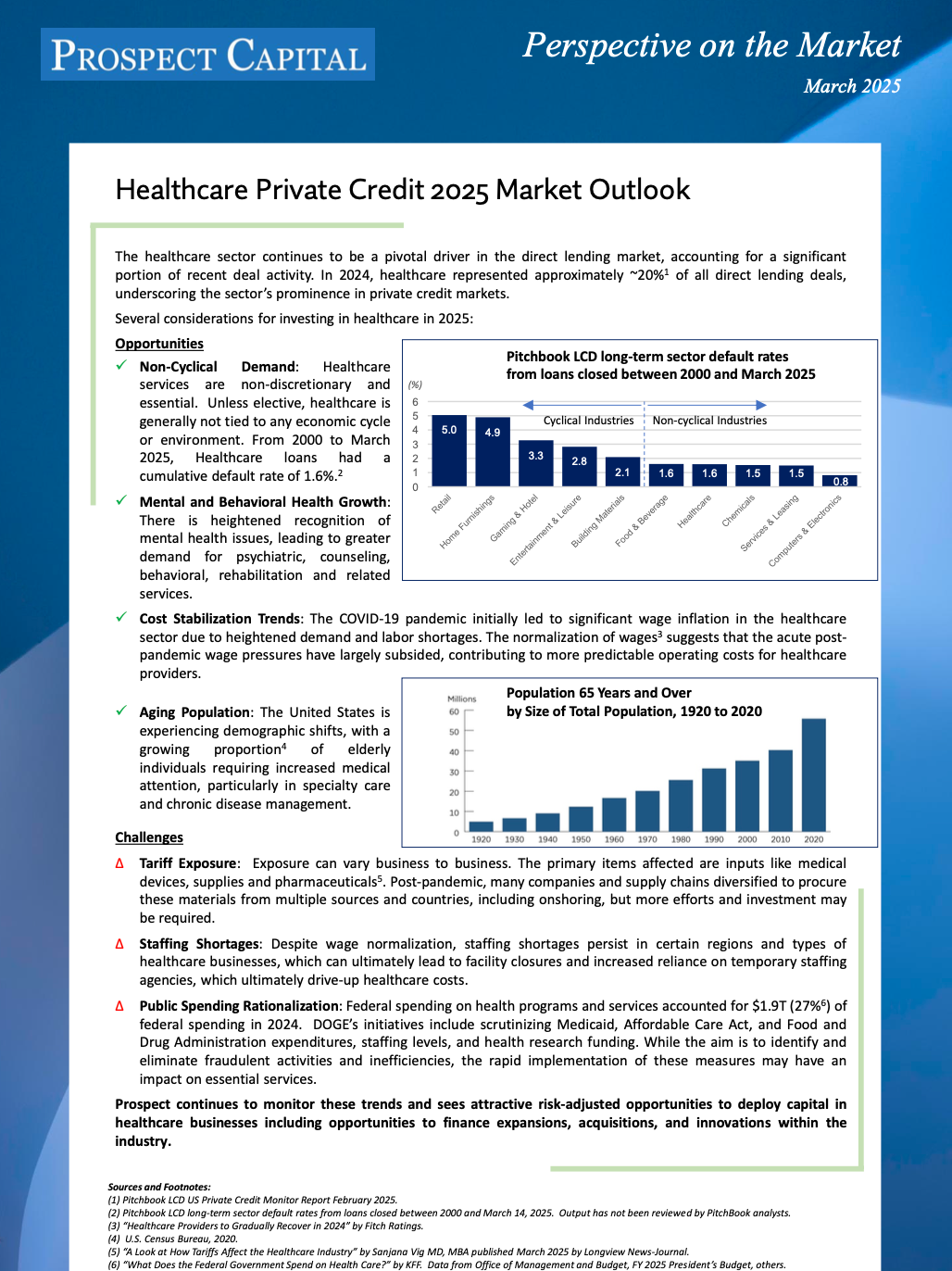

✓ Non-Cyclical Demand: Healthcare services are non-discretionary and essential. Unless elective, healthcare is generally not tied to any economic cycle or environment. From 2000 to March 2025, Healthcare loans had a cumulative default rate of 1.6%.2

✓ Mental and Behavioral Health Growth: There is heightened recognition of mental health issues, leading to greater demand for psychiatric, counseling, behavioral, rehabilitation and related services.

✓ Cost Stabilization Trends: The COVID-19 pandemic initially led to significant wage inflation in the healthcare sector due to heightened demand and labor shortages. The normalization of wages3 suggests that the acute post-pandemic wage pressures have largely subsided, contributing to more predictable operating costs for healthcare providers.

✓ Aging Population: The United States isexperiencing demographic shifts, with a growing proportion4 of elderly individuals requiring increased medical attention, particularly in specialty care and chronic disease management.

Challenges

∆ Tariff Exposure: Exposure can vary business to business. The primary items affected are inputs like medical devices, supplies and pharmaceuticals5. Post-pandemic, many companies and supply chains diversified to procure these materials from multiple sources and countries, including onshoring, but more efforts and investment may be required.

∆ Staffing Shortages: Despite wage normalization, staffing shortages persist in certain regions and types of healthcare businesses, which can ultimately lead to facility closures and increased reliance on temporary staffing agencies, which ultimately drive-up healthcare costs.

∆ Public Spending Rationalization: Federal spending on health programs and services accounted for $1.9T (27%6) of federal spending in 2024. DOGE’s initiatives include scrutinizing Medicaid, Affordable Care Act, and Food and Drug Administration expenditures, staffing levels, and health research funding. While the aim is to identify and eliminate fraudulent activities and inefficiencies, the rapid implementation of these measures may have an impact on essential services.

Prospect continues to monitor these trends and sees attractive risk-adjusted opportunities to deploy capital in healthcare businesses including opportunities to finance expansions, acquisitions, and innovations within the industry.

Sources and Footnotes:

- Pitchbook LCD US Private Credit Monitor Report February 2025.

- Pitchbook LCD long-term sector default rates from loans closed between 2000 and March 14, 2025. Output has not been reviewed by PitchBook analysts.

- “Healthcare Providers to Gradually Recover in 2024” by Fitch Ratings.

- U.S. Census Bureau, 2020.

- “A Look at How Tariffs Affect the Healthcare Industry” by Sanjana Vig MD, MBA published March 2025 by Longview News-Journal.

- “What Does the Federal Government Spend on Health Care?” by KFF. Data from Office of Management and Budget, FY 2025 President’s Budget, others.

Disclosures

Prospect Capital Management L.P. (“Prospect”) is an SEC registered investment adviser that was founded in 1988 (along with its predecessors). Prospect invests across the United States in diversified portfolios by industry, company, and situation, and its proprietary underwriting process and metrics have been developed over more than 30 years and through multiple economic cycles. Prospect has over 150 employees and $11.3 billion** of assets under management as of December 31, 2024. With a buy-and-hold mentality, Prospect’s objectives are to preserve capital by making credit and equity-focused investments at reasonable multiples of recurring cash flow, earn attractive current cash yields and long-term capital appreciation while achieving consistent low-volatility returns. For more information, call 212.448.0702 or visit prospectcap.com **The $11.3 billion of Assets Under Management (“AUM”) refers to the assets managed by Prospect and its affiliated registered investment advisors. AUM equals the sum of: (i) the gross assets of (a) Prospect Capital Corporation (“PSEC”), Priority Income Fund, Inc. (“PRIS”), Prospect Floating Rate and Alternative Income Fund, Inc. (“PFLOAT”), and (b) pooled investment vehicles with respect to discrete

assets for which Prospect has non-discretionary authority, (ii) any amounts available to be borrowed under certain credit facilities of the investment companies, (iii) total managed assets for real estate and structured credit investments, and (iv) uncalled capital commitments. Prospect’s AUM measure includes assets under management for which Prospect charges either nominal or zero fees. Prospect’s definition of AUM is not based on any definition of assets under management contained in any management agreements of the investment companies Prospect manages. Given the differences in the investment strategies and structures among other investment advisors, Prospect’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Prospect’s calculation also differs from the manner in which Prospect and its affiliates registered with the SEC report “Regulatory Assets Under Management” ($8.3 billion) on Form ADV.

This information is educational in nature and does not constitute an offer to sell or the solicitation of an offer to buy any securities. All statements, assumptions and opinions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Recipients should not view the past performance of middle-market loans as being indicative of future results. Prospect is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Prospect cannot guarantee that the information herein is accurate, complete or timely. We make no representation or warranty in respect of any information derived from the third-party sources which has not been independently verified.

Past Performance is not indicative of future results.

Prospective investors should be aware that an investment in any private credit strategy is speculative and involves a high degree of risk that is suitable only for those investors who have the financial sophistication and expertise to evaluate the merits and risks of such investment and for which the investment does not represent a complete investment program. An investment should only be considered by persons who can afford a loss of their entire investment.

This material is not intended to replace any the materials that would be provided in connection with an investor’s consideration to invest in an actual private credit strategy, which would only be done pursuant to the terms of a confidential private placement memorandum and other related material. Prospective investors are urged to consult with their own tax and legal advisors about the implications of investing in a private credit strategy, including the risks and fees of such an investment.