The Federal Reserve began raising interest rates in March 2022 and continued at the fastest pace in decades. This sharp increase dampened origination activity into the first half of 2023 before picking up in Q3 2023. We expect more robust origination volume from refinancings and M&A in 2024, which benefits the private credit industry as stronger deal flow allows lenders to be more selective.

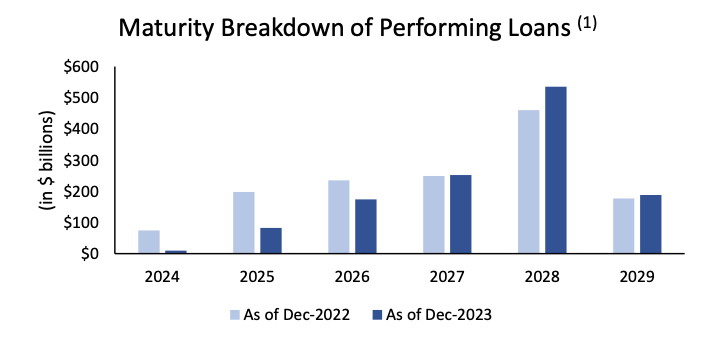

- Borrowers have put off refinancing into new facilities in the prior two years, instead opting for “amend-and-extend” transactions that push out loan maturities by one or two years. This has resulted in looming maturity walls from 2025 onwards. Loans tend to be refinanced up to a year out, so we expect greater refinancing activity in 2024 compared to the prior year.

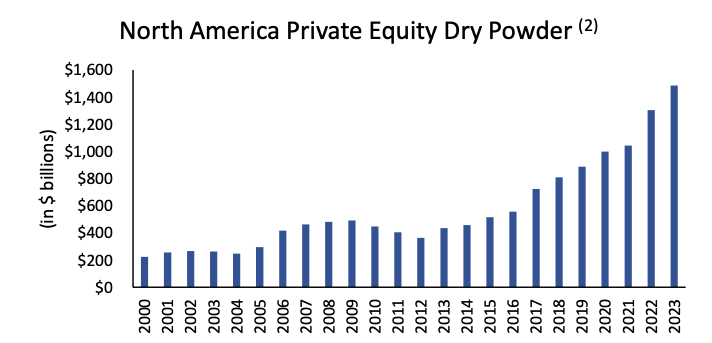

- The M&A market was depressed for most of 2022 and 2023 as economic uncertainty, inflationary pressures, and higher interest rates prevented buyers and sellers from being on the same page in terms of valuations. This has contributed to a backlog of deals in the pipeline and a record amount of private equity dry powder sitting on the sidelines. As of December 2023, there was $1.5 trillion of private equity capital waiting to be deployed. Meanwhile, investment banks have reported a greater number of deal pitches since late 2023, which is a leading indicator of deal activity.

Footnotes:

(1) Pitchbook and Morningstar LSTA US Leveraged Loan Index.

(2) Preqin.

Disclosures

Past Performance is not indicative of future results

Prospect Capital Management L.P. (“Prospect”)

Prospect is an SEC registered investment adviser that was founded in 1988 (along with its predecessors). Prospect invests across the United States in diversified portfolios by industry, company, and situation, and its proprietary underwriting process and metrics have been developed over more than 30 years and through multiple economic cycles. Prospect has over 100 employees and $11.7 billion** of assets under management as of June 30, 2023. With a buy-and-hold mentality, Prospect’s objectives are to preserve capital by making credit and equity-focused investments at reasonable multiples of recurring cash flow, earn attractive current cash yields and long-term capital appreciation while achieving consistent low-volatility returns. For more information, call 212.448.0702 or visit prospectcap.com

**The $11.7 billion of Assets Under Management (“AUM”) refers to the assets managed by Prospect and its affiliated registered investment advisors. AUM equals the sum of: (i) the gross assets of Prospect Capital Corporation (“PSEC”), Priority Income Fund, Inc. (“PRIS”), and Prospect Floating Rate and Alternative Income Fund, Inc. (“PFLOAT”), (ii) any amounts available to be borrowed under certain credit facilities of the investment companies, (iii) total managed assets for real estate and structured credit investments, and (iv) uncalled capital commitments. Prospect’s AUM measure includes assets under management for which Prospect charges either nominal or zero fees. Prospect’s definition of AUM is not based on any definition of assets under management contained in any management agreements of the investment companies Prospect manages. Given the differences in the investment strategies and structures among other investment advisors, Prospect’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Prospect’s calculation also differs from the manner in which Prospect and its affiliates registered with the SEC report “Regulatory Assets Under Management” ($8.8 billion) on Form ADV.

This information is educational in nature and does not constitute an offer to sell or the solicitation of an offer to buy any securities. Recipients should not view the past performance of middle-market loans as being indicative of future results. Prospect is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Prospect cannot guarantee that the information herein is accurate, complete or timely. We make no representation or warranty in respect of any information derived from the third-party sources which has not been independently verified.