In the wake of an unprecedented economic cycle, we have noticed an uptick in conversation regarding middle-market loans. Specifically, investors have expressed concern that the middle and lower middle-market segments of private credit are riskier than other segments.

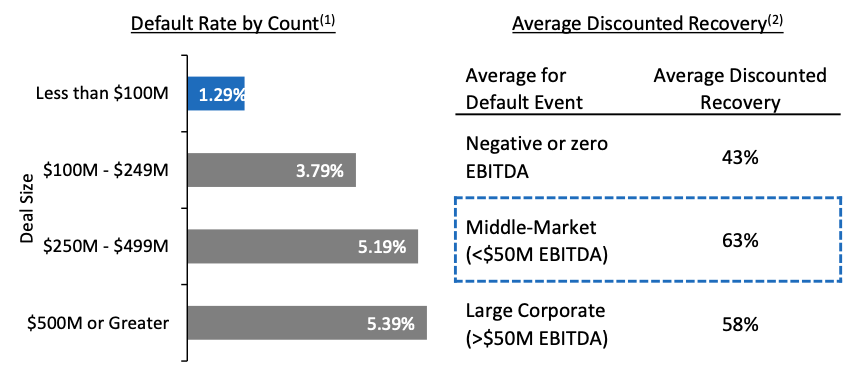

Historical data reveals a compelling narrative. Contrary to popular belief, core middle-market loans have proven to be remarkably resilient, with lower default rates and higher recoveries than their larger loan counterparts.

While it’s not surprising that large companies can be risky and default, it’s less obvious that smaller companies can have strong financials and low credit risk on par with or better than their larger counterparts. We identify several key takeaways that we believe can be a source of investment strength with the right investor:

- Size Isn’t Everything: From a credit risk perspective, it is easy to fixate on the size of a company, but overemphasizing company size can lead to missed investment

opportunities. - Diversification Benefits: Investing in many smaller firms can further improve portfolio diversification.

- Lender Advantages: Core middle-market deals often have lower leverage, tighter documentation, and better covenants when compared to their larger loan counterparts.

- Challenging “Bigger is Better”: The popular phrase does not always hold true in the world of credit. Smaller companies challenge the conventional wisdom that size equates to safety. Bigger is not always better, but it is more competitive.

Disclosures

Past Performance is not indicative of future results

Prospect Capital Management L.P. (“Prospect”)

Prospect is an SEC registered investment adviser that was founded in 1988 (along with its predecessors). Prospect invests across the United States in diversified portfolios by industry, company, and situation, and its proprietary underwriting process and metrics have been developed over more than 30 years and through multiple economic cycles. Prospect has over 100 employees and $11.7 billion** of assets under management as of June 30, 2023. With a buy-and-hold mentality, Prospect’s objectives are to preserve capital by making credit and equity-focused investments at reasonable multiples of recurring cash flow, earn attractive current cash yields and long-term capital appreciation while achieving consistent low-volatility returns. For more information, call 212.448.0702 or visit prospectcap.com

**The $11.7 billion of Assets Under Management (“AUM”) refers to the assets managed by Prospect and its affiliated registered investment advisors. AUM equals the sum of: (i) the gross assets of Prospect Capital Corporation (“PSEC”), Priority Income Fund, Inc. (“PRIS”), and Prospect Floating Rate and Alternative Income Fund, Inc. (“PFLOAT”), (ii) any amounts available to be borrowed under certain credit facilities of the investment companies, (iii) total managed assets for real estate and structured credit investments, and (iv) uncalled capital commitments. Prospect’s AUM measure includes assets under management for which Prospect charges either nominal or zero fees. Prospect’s definition of AUM is not based on any definition of assets under management contained in any management agreements of the investment companies Prospect manages. Given the differences in the investment strategies and structures among other investment advisors, Prospect’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Prospect’s calculation also differs from the manner in which Prospect and its affiliates registered with the SEC report “Regulatory Assets Under Management” ($8.8 billion) on Form ADV.

This information is educational in nature and does not constitute an offer to sell or the solicitation of an offer to buy any securities. Recipients should not view the past performance of middle-market loans as being indicative of future results. Prospect is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Prospect cannot guarantee that the information herein is accurate, complete or timely. We make no representation or warranty in respect of any information derived from the third-party sources which has not been independently verified.